erp system accounting is revolutionizing the way businesses manage their financial operations. By integrating various accounting functions into a cohesive system, organizations can enhance productivity, improve accuracy, and gain valuable insights into their financial health. This overview dives into the essential components of ERP systems, their benefits, challenges, and the role of data analytics, making it clear why this technology is becoming indispensable for modern accounting practices.

From understanding the fundamental modules that drive these systems to exploring future trends like AI integration, we’ll uncover the full scope of how ERP systems contribute to more efficient and informed decision-making within businesses.

The fundamental components of an ERP system accounting setup must be d.

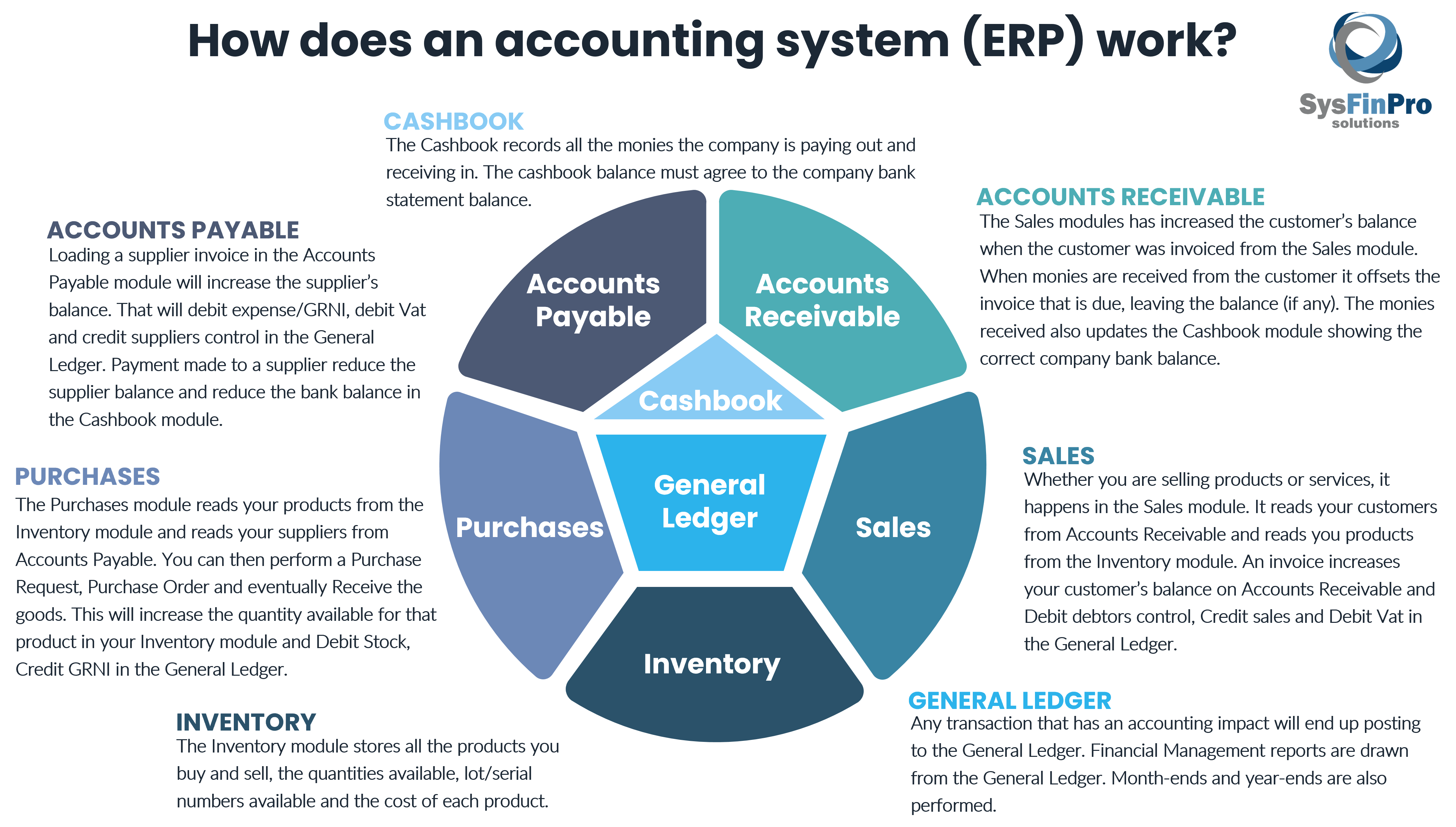

An effective ERP system for accounting is essential for businesses aiming to streamline their financial processes and ensure accurate reporting. The foundation of this system is built upon several key components that work together to provide a comprehensive solution for managing finances. Understanding these components is crucial for businesses looking to optimize their accounting practices.

Essential modules of an ERP system for accounting

An ERP accounting system typically consists of several modules that cover different aspects of financial management. Each module plays a specific role, contributing to the overall effectiveness and efficiency of the accounting process. Here are the core modules typically found in ERP accounting systems:

- General Ledger: The central component that keeps track of all financial transactions within the organization. It serves as the backbone of financial reporting and provides real-time data for decision-making.

- Accounts Payable: This module manages all outgoing payments, ensuring that vendors and suppliers are paid on time. It streamlines the invoice processing and payment approval workflows.

- Accounts Receivable: This module oversees incoming payments from customers, tracking invoices, and managing credit and collections processes. It helps in maintaining cash flow and customer relationships.

- Fixed Assets Management: This module tracks the organization’s assets, including acquisition, depreciation, and disposal. It ensures compliance with accounting standards and helps in asset management and reporting.

- Budgeting and Forecasting: This module enables businesses to create budgets and forecasts, allowing for better financial planning and analysis. It helps in tracking performance against set objectives.

- Financial Reporting: This module generates various financial statements and reports, providing insights into the organization’s financial health. It aids in compliance with regulatory requirements and supports strategic decision-making.

Popular ERP accounting systems and their functionalities

Several ERP systems are widely recognized for their accounting capabilities. Some of the most popular include:

- SAP ERP: Known for its robust functionalities, SAP ERP includes modules for financial accounting, controlling, and asset management. It supports complex organizational structures and compliance requirements.

- Oracle NetSuite: A cloud-based ERP solution that offers integrated financial management, including accounting, CRM, and e-commerce functionalities. It is particularly favored by small to medium-sized enterprises (SMEs) for its scalability.

- Microsoft Dynamics 365: This platform combines ERP and CRM capabilities, offering comprehensive financial management, project accounting, and analytics. It integrates seamlessly with other Microsoft products.

- QuickBooks Enterprise: Designed for small to medium businesses, QuickBooks provides essential accounting features, such as invoicing, payroll, and inventory management, along with reporting capabilities.

Integration of various business processes within the ERP accounting system

The power of an ERP accounting system lies in its ability to integrate various business processes into a cohesive framework. This integration ensures that all departments are aligned, which enhances efficiency and reduces errors. A few key aspects of this integration include:

- Real-time Data Sharing: The system allows different departments, such as sales and procurement, to access real-time financial data, promoting informed decision-making across the organization.

- Streamlined Workflows: By automating processes such as invoicing and reconciliation, the ERP system reduces manual work, minimizes errors, and accelerates business operations.

- Enhanced Reporting and Analytics: The integration of data from various functions facilitates comprehensive reporting, allowing for better financial analysis and forecasting.

- Compliance and Risk Management: An integrated ERP system helps organizations maintain compliance with financial regulations by providing standardized processes and accurate reporting.

“An efficient ERP accounting system not only simplifies financial management but also aligns it with overall business processes, leading to improved performance and decision-making.”

The benefits of implementing an ERP system accounting solution should be highlighted.

The integration of an ERP system in accounting brings a myriad of advantages that can significantly transform how businesses operate. By streamlining processes and providing centralized information, ERP systems empower organizations to enhance their overall efficiency and decision-making capabilities. Below, we will explore some noteworthy benefits that companies experience when adopting ERP accounting solutions.

Enhanced Operational Efficiency

Implementing an ERP system simplifies and automates various accounting processes, which leads to substantial improvements in operational efficiency. This centralization of data reduces manual entries and the likelihood of errors, resulting in time and cost savings. For instance, a manufacturing company that previously managed its accounting through disparate systems reported a 30% reduction in processing time after transitioning to an ERP system.

By having real-time access to financial data, the finance team could respond swiftly to any discrepancies and streamline invoice processing.

Improved Data Accuracy and Reporting

Accurate data is crucial for effective decision-making. ERP systems consolidate data from various departments into a single system, improving data integrity and accuracy. This reduces discrepancies that often arise from data being entered or managed in multiple systems.A retail chain, for example, found that by implementing an ERP accounting system, they could generate financial reports in minutes rather than days.

This not only freed up their accounting staff to focus on strategic tasks but also provided management with timely insights to make informed decisions.

Enhanced Decision-Making Processes, Erp system accounting

ERP systems significantly enhance the decision-making process within organizations by providing comprehensive and real-time data analytics. Managers have access to dashboards that present key performance indicators (KPIs) and financial metrics, enabling them to identify trends and make impactful decisions.For example, a technology firm utilized ERP analytics to monitor sales performance across different regions. They discovered that one region consistently outperformed others.

Acting on this insight, they redirected resources and marketing efforts to maximize sales in underperforming areas, ultimately boosting overall revenue by 15%.In summary, the implementation of an ERP system accounting solution not only improves operational efficiency and data accuracy but also enhances decision-making capabilities within organizations. The impact of these systems is evident through real-world examples, demonstrating their value in today’s fast-paced business environment.

The challenges associated with transitioning to an ERP system accounting framework need to be examined.

Transitioning to an ERP system for accounting can be a complex journey, filled with various challenges that organizations must navigate. Understanding these obstacles is crucial for a smooth implementation process. Companies often find themselves grappling with issues ranging from resistance to change among staff to technical difficulties during integration. Identifying these challenges early can lead to more effective strategies for overcoming them.One of the primary challenges organizations face is the resistance to change from employees accustomed to legacy systems or manual processes.

This resistance can stem from fear of the unknown or concerns about job security. Additionally, there are the technical hurdles associated with data migration, where existing data must be accurately transferred to the new system without loss or corruption. Budget constraints can also complicate the transition, leading to inadequate training or insufficient resources allocated for the project.

Common Obstacles in ERP Implementation

Several obstacles can impede a successful ERP accounting implementation. Addressing these issues proactively can significantly enhance the likelihood of achieving desired outcomes. Below are common challenges faced during this transition:

- Employee Resistance: Many staff members are hesitant to adopt new systems, fearing it may disrupt their workflow or require them to learn new skills.

- Data Migration Issues: Transferring data from legacy systems to the new ERP can lead to data integrity problems if not handled properly.

- Insufficient Training: Employees may not receive adequate training, which can hinder their ability to utilize the new system effectively.

- Budget Constraints: Organizations often underestimate the total cost of ownership, leading to budget shortfalls that affect implementation quality.

- Change Management: Inadequate change management processes can result in confusion and poor user adoption across the organization.

To successfully navigate these challenges, companies should develop comprehensive strategies.

Strategies to Overcome Challenges

Implementing effective strategies is essential to address the challenges associated with ERP transitions. Here are some tactics organizations can utilize:

- Engage Employees Early: Involve team members from the onset, allowing them to voice concerns and participate in the planning process, which can mitigate resistance.

- Conduct Thorough Training: Develop a robust training program that caters to various employee skill levels, ensuring everyone is equipped to use the new system confidently.

- Implement a Phased Approach: Gradually rolling out the ERP system can help to manage change effectively and minimize disruption.

- Secure Executive Sponsorship: Gaining support from top management helps to emphasize the importance of the transition and encourages employee buy-in.

- Utilize Change Management Best Practices: Employ change management frameworks that address both the technical and human aspects of the transition.

Recognizing potential pitfalls during the ERP accounting transition is crucial for preventing setbacks that could derail the project.

Potential Pitfalls and How to Avoid Them

Certain pitfalls can arise during the ERP implementation process, and being aware of these can help organizations avoid costly mistakes.

- Neglecting User Input: Failing to incorporate feedback from end-users throughout the transition can create a system that does not meet actual needs.

- Overlooking Post-Implementation Support: Without ongoing support, users may struggle to adapt to the new system, leading to frustration and decreased usage.

- Inadequate Testing: Skipping thorough testing phases can result in undetected errors that affect functionality once the system goes live.

- Ignoring Data Quality: Poor data quality can lead to significant issues in reporting and analysis, undermining the benefits of the ERP system.

- Setting Unrealistic Timelines: Rushing the implementation process can lead to oversights and incomplete integration, causing long-term challenges.

The role of data analytics within an ERP system accounting environment should be explored.

In the rapidly evolving landscape of business, data analytics has emerged as a critical component of an ERP system’s accounting framework. The integration of data-driven insights allows organizations to make informed decisions, enhance operational efficiency, and ultimately drive profitability. By leveraging the analytical capabilities embedded within ERP systems, businesses can transform their accounting practices from reactive to proactive management.Data-driven insights are pivotal for accounting practices within an ERP system, enabling organizations to access, analyze, and interpret financial data in real-time.

This approach not only streamlines financial reporting but also assists in forecasting trends, managing budgets, and identifying areas for improvement. By harnessing these insights, companies can respond swiftly to market changes and optimize their financial strategies, resulting in more accurate financial predictions and enhanced strategic planning.

Leveraging analytics tools for financial reporting optimization

Analytics tools integrated into ERP systems provide a wealth of information that can be utilized to enhance financial reporting. Through these tools, organizations can conduct deep dives into their financial data, uncovering patterns and relationships that may otherwise go unnoticed. The benefits of utilizing these analytics tools include improved accuracy in reporting, reduced time spent on data collection, and the ability to generate reports that are tailored to specific business needs.Key performance indicators (KPIs) are crucial for assessing an organization’s financial health and operational efficiency.

Here are several examples of KPIs that can be effectively tracked through ERP accounting systems:

- Gross Profit Margin: This KPI measures the difference between revenue and cost of goods sold, highlighting the profitability of core business operations.

- Net Profit Margin: A key indicator of overall profitability, this KPI shows the percentage of revenue that remains as profit after all expenses are accounted for.

- Current Ratio: This liquidity ratio measures the ability of a business to meet its short-term obligations and is calculated by dividing current assets by current liabilities.

- Accounts Receivable Turnover: This metric assesses how effectively a company collects its receivables by measuring the number of times accounts receivable are collected during a specific period.

- Return on Assets (ROA): This KPI indicates how efficiently a company uses its assets to generate profit, calculated by dividing net income by total assets.

- Budget Variance: This measures the difference between budgeted and actual financial performance, helping organizations identify discrepancies and areas needing attention.

By systematically tracking these KPIs, businesses can leverage the insights gained from their ERP systems to refine their accounting practices, align their strategies with financial goals, and enhance overall business performance.

The future trends in ERP system accounting must be assessed.

The landscape of ERP system accounting is rapidly evolving, shaped by advances in technology and changing business needs. As organizations seek to enhance efficiency, reduce costs, and make data-driven decisions, it becomes essential to stay informed about the future trends that will influence ERP systems in accounting. This examination will highlight some of the emerging technologies, predictions over the next five years, and strategies for adapting to these trends.

Emerging Technologies Influencing ERP Systems

Several technologies are on the cusp of transforming how ERP systems operate within the accounting sector. The integration of AI and machine learning is particularly significant as these technologies can automate repetitive tasks, enhance data accuracy, and provide predictive insights.

- Artificial Intelligence (AI): AI enables advanced data processing and automation, allowing for quicker financial analysis and reporting. This technology can help identify anomalies and assist in fraud detection, thereby enhancing financial controls.

- Machine Learning: By analyzing vast amounts of financial data, machine learning algorithms can identify trends and patterns, allowing businesses to make more informed decisions and forecasts.

- Cloud Computing: Cloud-based ERP solutions facilitate remote access and collaboration, essential for modern businesses operating in hybrid work environments. This technology also provides scalability to adapt to changing business needs.

- Blockchain: The potential of blockchain technology in accounting includes increased transparency and security in transactions, ensuring that all financial activities are recorded accurately and immutably.

Predictions for ERP Accounting Solutions in the Next Five Years

The next five years are expected to bring significant changes to ERP accounting solutions, driven by both technological advancements and evolving business requirements. Organizations can anticipate several key developments:

- Increased Automation: The adoption of robotic process automation (RPA) will continue to rise, leading to a reduction in manual data entry and an increase in efficiency across financial processes.

- Enhanced User Experience: ERP systems will increasingly focus on user-friendly interfaces and personalized dashboards, allowing accountants and finance professionals to access critical information more intuitively.

- Integration with Other Business Functions: Future ERP systems will offer improved integration capabilities with other business applications, enabling seamless data flow and collaboration across departments.

- Real-Time Analytics: Organizations will increasingly rely on real-time data analytics for timely decision-making, with ERP systems providing immediate insights into financial performance and forecasts.

Preparing for Upcoming Trends in Accounting Practices

As businesses look ahead, preparation for these emerging trends is crucial. Adapting accounting practices to leverage the benefits of new technologies will ensure that organizations remain competitive.

- Invest in Training: Ongoing education and training programs for accounting teams will be vital to harness the potential of AI, machine learning, and other technologies effectively.

- Adopt Agile Methodologies: Embracing agile practices can help businesses respond quickly to changes in technology and market dynamics, ensuring that their ERP systems remain relevant.

- Focus on Data Security: As reliance on digital solutions increases, businesses must prioritize robust cybersecurity measures to protect sensitive financial data.

- Evaluate ERP Vendors: Companies should carefully assess ERP vendors based on their technological capabilities and commitment to innovation, ensuring they choose partners that align with their strategic goals.

As the ERP landscape evolves, staying ahead of technological advancements will be key to unlocking new efficiencies and insights in accounting.

The integration process of ERP systems with other business applications should be d.

Integrating ERP accounting systems with other business applications is essential for organizations aiming to optimize their operations and ensure a smooth flow of information. By linking these systems, businesses can achieve a holistic view of their data, which is crucial for making informed decisions. This integration not only enhances efficiency but also fosters collaboration across departments.

Importance of Integrating ERP Systems with CRM and Supply Chain Management Tools

Integrating ERP systems with Customer Relationship Management (CRM) and Supply Chain Management (SCM) tools creates a cohesive environment that supports various business functions. The significance of this integration can be highlighted through several key factors:

- Enhanced Data Accuracy: When data flows seamlessly between the ERP, CRM, and SCM systems, the likelihood of errors decreases significantly. For instance, sales teams can access real-time inventory levels, helping them avoid over-promising on product availability.

- Improved Customer Experience: With integrated systems, customer service representatives can track order statuses, inventory levels, and customer interactions in one place. This leads to more informed responses and quicker resolutions, ultimately enhancing customer satisfaction.

- Streamlined Processes: Integrating these systems automates data transfer, reducing the need for manual entries and minimizing delays. For example, once an order is processed in the ERP system, it automatically updates the CRM and SCM, ensuring all departments are aligned.

Technical Aspects of Seamless Integration

Achieving seamless integration between ERP systems and other business applications involves addressing several technical aspects. This encompasses data mapping, API usage, and middleware solutions. First, data mapping ensures that data formats are compatible across different systems. Standardizing fields such as customer names, product SKUs, and prices can facilitate smoother data exchanges. Additionally, using Application Programming Interfaces (APIs) allows for real-time connectivity between systems, enabling immediate updates and access to data.Middleware solutions act as intermediaries that manage data transfer and translate requests between disparate systems.

This technology helps address discrepancies in data formats and communication protocols, allowing for a more fluid integration.

Examples of Successful Integrations Leading to Increased Operational Efficiency

Numerous organizations have experienced substantial gains in operational efficiency following the integration of their ERP systems with CRM and SCM tools. For example, a well-known manufacturing company integrated its ERP with its SCM system, resulting in a 30% reduction in order processing time. By enabling real-time updates on inventory and production schedules, the company could respond more swiftly to customer demands, thereby enhancing their competitive edge.Another notable case is a retail company that integrated its ERP with its CRM.

This integration allowed the company to analyze customer purchasing behaviors and trends more effectively. As a result, they implemented targeted marketing campaigns that led to a 20% increase in sales within a single quarter.These examples illustrate the tangible benefits of a well-executed integration process, showcasing how organizations can leverage technology to streamline operations and drive growth.

Obtain recommendations related to best accounting software for inventory that can assist you today.

The impact of cloud technology on ERP system accounting must be discussed.

As businesses increasingly move towards digital transformations, cloud technology has emerged as a game-changer in the realm of ERP system accounting. The integration of cloud solutions within ERP frameworks offers various advantages, revolutionizing how accounting tasks are executed and managed. This discussion highlights the advantages, risks, and benefits associated with adopting cloud-based ERP systems for accounting processes.

Advantages of Utilizing Cloud-Based ERP Systems for Accounting Purposes

Cloud-based ERP systems have rapidly gained traction due to their ability to streamline operations and reduce costs. Below are some key benefits of employing cloud technology in accounting:

- Cost-Effectiveness: Cloud-based ERP solutions often lower initial capital expenditures as they eliminate the need for extensive hardware and infrastructure. Businesses typically pay for cloud services on a subscription basis, allowing for better financial planning.

- Automatic Updates: Cloud ERP systems receive regular updates and enhancements automatically, ensuring that users have access to the latest features and compliance standards without manual intervention.

- Accessibility: With internet access, accounting teams can work remotely, accessing real-time data from anywhere, which improves collaboration and decision-making.

- Data Security: Reputable cloud service providers implement advanced security measures and protocols, reducing the risk of data breaches compared to traditional on-premises solutions.

Potential Risks and Considerations When Moving to the Cloud

Transitioning to a cloud-based ERP system does come with its set of challenges and risks that organizations must carefully consider. Some potential risks include:

- Data Privacy Concerns: Storing sensitive financial data on the cloud can raise concerns regarding data privacy, and businesses need to ensure compliance with regulations such as GDPR.

- Downtime Risks: While cloud providers generally offer high uptime, outages can still occur, potentially disrupting access to critical accounting functions.

- Vendor Lock-In: Organizations may find it challenging to migrate away from a cloud provider due to compatibility issues, making it essential to choose a provider with flexible options.

Scalability and Accessibility Benefits for Accounting Teams

Cloud ERP systems offer significant scalability and accessibility advantages that can greatly benefit accounting teams. These features enable organizations to adapt their systems as they grow, ensuring that financial operations remain efficient.

- Scalability: Cloud solutions can easily accommodate business growth by allowing companies to add or reduce resources based on demand without the hassle of physical infrastructure changes.

- Enhanced Collaboration: Cloud platforms facilitate real-time collaboration between accounting teams and other departments, enabling more effective communication and data sharing.

- Integration with Other Applications: Cloud ERP systems can be seamlessly integrated with other business applications, providing a holistic view of financial health and operational performance.

“Cloud technology enables accounting functions to be more agile, allowing teams to focus on strategic initiatives rather than IT resource management.”

The importance of user training and support in ERP system accounting should be emphasized.

Implementing an ERP accounting system isn’t merely a technical upgrade; it’s a transformative shift in how an organization manages its financial data. To maximize the benefits of this robust system, effective user training and ongoing support are crucial components. Well-trained employees are more likely to embrace the system, leading to improved data accuracy, operational efficiency, and overall satisfaction.A successful training program for users of ERP accounting systems focuses on equipping employees with the skills and knowledge they need to navigate the system confidently.

Key components of such a program include structured learning paths, hands-on practice, and access to comprehensive resources. This multi-faceted approach ensures that users are not only familiar with the system’s functions but also understand how to apply them in real-world scenarios.

Key components of a successful training program

An effective training program should incorporate several essential elements to enhance user competency:

- Role-specific training: Tailoring training sessions to different user roles ensures that employees learn features relevant to their specific functions within the organization, enhancing engagement and utility.

- Hands-on experience: Providing users with the opportunity to practice using the ERP system in a controlled environment allows them to gain confidence and troubleshoot potential issues before going live.

- Comprehensive documentation: Detailed manuals, quick-reference guides, and online tutorials should be readily available to users, serving as valuable resources for ongoing learning.

- Regular workshops and refresher courses: Offering periodic training sessions helps reinforce skills and introduces users to new features or updates, ensuring they stay proficient in operating the system.

Ongoing support is a vital aspect of ensuring user success after the ERP system has been implemented. Providing a structured support system helps employees feel confident in their ability to resolve issues and seek assistance when needed.

Ongoing support for employees post-implementation

Establishing a robust support framework is essential for addressing user needs and maintaining productivity. Key elements include:

- Helpdesk services: A dedicated helpdesk can provide immediate assistance for technical issues, offering users a reliable resource for troubleshooting and problem resolution.

- Peer support networks: Encouraging collaboration among users through forums or informal groups fosters a sense of community where employees can share tips and solutions.

- Regular feedback sessions: Conducting follow-up meetings to gather user feedback allows the organization to identify pain points and areas for further training, ensuring continuous improvement.

Effective training methods and resources can significantly enhance user proficiency, making the transition to an ERP accounting system smoother and more successful.

Effective training methods and resources

Utilizing a variety of training methods can cater to diverse learning styles and preferences among employees. Some effective approaches include:

- Interactive e-learning modules: Online courses that incorporate quizzes and simulations engage users and enhance retention of information.

- On-site training sessions: Face-to-face workshops provide personalized instruction and the opportunity for direct interaction with trainers, facilitating immediate feedback and clarification.

- Video tutorials: Short, focused videos that demonstrate specific tasks or features can be a quick and accessible way for users to learn at their own pace.

By prioritizing user training and support, organizations can ensure a smoother transition to their ERP accounting systems, ultimately leading to higher efficiency, productivity, and user satisfaction.

Final Conclusion

In conclusion, the integration of erp system accounting into business processes not only enhances operational efficiency but also empowers organizations with critical data-driven insights. As we navigate the challenges and opportunities presented by this technology, it is essential to stay informed about emerging trends and continue investing in user training and support. By doing so, businesses can fully leverage the potential of ERP systems for their accounting needs, ensuring sustainable growth and success.

Answers to Common Questions

What is an ERP system accounting?

An ERP system accounting is an integrated software platform that manages and automates accounting processes, providing a unified view of financial data across an organization.

How does an ERP system improve decision-making?

By providing real-time data and analytics, an ERP system enables quicker and more informed decision-making, helping businesses respond to financial trends and challenges effectively.

What are the common challenges when implementing ERP accounting?

Common challenges include resistance to change, data migration issues, and the need for comprehensive user training and support during the transition.

How can companies ensure successful ERP integration?

Companies can ensure successful integration by carefully planning the implementation process, involving key stakeholders, and providing adequate training and support to all users.

What role does cloud technology play in ERP systems?

Cloud technology enhances ERP systems by offering scalability, accessibility, and cost-effectiveness while reducing the need for extensive on-premise infrastructure.