Accounting software for manufacturing business has become an essential tool for companies looking to streamline their operations and improve financial accuracy. In the fast-paced world of manufacturing, having the right accounting software can make a significant difference in managing costs, tracking inventory, and ensuring compliance. This overview dives into the unique requirements of manufacturing businesses, the importance of integrating accounting solutions with other tools, and the future trends that may shape this vital sector.

Manufacturing businesses face distinct challenges that set them apart from other industries, primarily due to complex inventory management and the need for precise cost tracking. Understanding these unique needs is crucial when selecting accounting software, as it ensures that the features provided can effectively support production scheduling and resource allocation. With advancements in technology, the landscape of accounting software for the manufacturing sector is ever-evolving, making it essential for businesses to stay informed about their options.

Understanding the Unique Needs of Manufacturing Businesses When Choosing Accounting Software

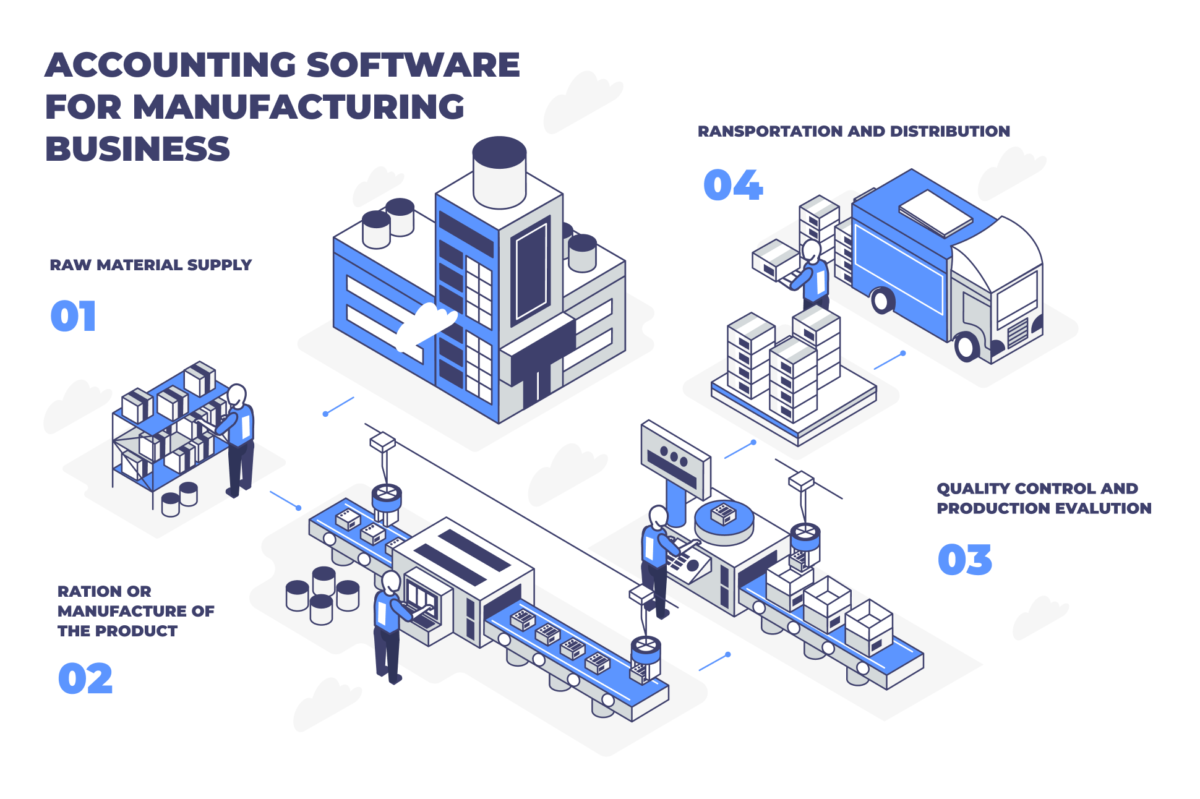

Manufacturing businesses operate in a landscape defined by complexity, where inventory management, production scheduling, and cost tracking are crucial to maintaining efficiency and profitability. Selecting the right accounting software is essential to meet these specific operational demands, ensuring that manufacturers can effectively manage their resources and financial performance.Manufacturing businesses require a distinct set of features in accounting software that differentiate them from other industries.

These needs stem from the intricate processes involved in manufacturing, including sourcing raw materials, managing work-in-progress, and maintaining finished goods. Essential features include robust inventory management systems, detailed production scheduling capabilities, and comprehensive cost tracking tools that provide insights into each phase of the manufacturing process.

Key Features for Manufacturing Accounting Software

Understanding the features that are particularly beneficial for manufacturing is critical for making an informed decision. These features not only streamline operations but also enhance the ability to track performance metrics effectively.

- Inventory Management: Advanced inventory management is vital for manufacturing. It should allow for real-time tracking of raw materials, work-in-progress, and finished goods. These capabilities enable manufacturers to minimize waste and reduce carrying costs.

- Production Scheduling: This feature helps manufacturers plan production runs efficiently, taking into account machine availability, labor, and material requirements. Effective production scheduling can prevent downtime and ensure timely deliveries to customers.

- Cost Tracking: Comprehensive cost tracking tools allow manufacturers to monitor expenses related to materials, labor, and overhead. Accurate cost tracking helps in pricing products appropriately and identifying areas for cost reduction.

- Reporting and Analytics: Manufacturing accounting software should provide customizable reports and dashboards that offer insights into key performance indicators (KPIs). This data-driven approach enables better decision-making and strategic planning.

- Integration Capabilities: The ability to integrate with other systems, such as supply chain management and enterprise resource planning (ERP) software, is crucial for manufacturing businesses. This ensures seamless data flows and enhances overall operational efficiency.

The unique requirements of manufacturing businesses lead to a need for specialized accounting software. Unlike service-oriented industries, manufacturers deal with tangible goods, necessitating precise tracking and management of physical inventory and production processes. This complexity demands a comprehensive understanding of both accounting principles and manufacturing operations, highlighting the necessity for tailored solutions that cater specifically to the nuances of the manufacturing sector.

Comparing Popular Accounting Software Solutions for Manufacturing

Manufacturing businesses require specialized accounting solutions that can accommodate their unique needs, such as inventory management, job costing, and compliance with industry regulations. With various software options available, it’s crucial to compare the leading solutions to determine which best meets the requirements of a manufacturing operation. This analysis will delve into three prominent accounting software solutions: QuickBooks Desktop for Manufacturing, Sage 100cloud, and Fishbowl Manufacturing.

Comparison of Leading Accounting Software Solutions

When selecting accounting software for manufacturing, it’s essential to consider the specific features and functionalities that can enhance operational efficiency. Below is a comparison of three leading solutions, detailing their strengths and weaknesses in relation to manufacturing needs.

-

QuickBooks Desktop for Manufacturing

QuickBooks remains a popular choice for small to medium-sized manufacturing businesses due to its user-friendly interface and comprehensive features.

Strengths include:

- Intuitive dashboard design simplifying financial tracking and reporting.

- Robust inventory management capabilities that cater to manufacturers.

- Integration with various third-party applications to enhance functionality.

However, its weaknesses consist of:

- Limited scalability for larger manufacturing operations.

- Some features may require additional cost for advanced functionalities.

QuickBooks can significantly impact manufacturing efficiency by allowing real-time tracking of inventory levels, which helps prevent stockouts or overstocking. Furthermore, its reporting tools enable better financial insights, leading to more informed strategic decisions.

- Sage 100cloud

Sage 100cloud is tailored for manufacturers, offering an extensive suite of tools to manage complex manufacturing processes.

Strengths include:

- Robust manufacturing resource planning (MRP) features to optimize production schedules.

- Comprehensive accounting and compliance functionalities specifically designed for manufacturers.

- Strong reporting capabilities that provide deep insights into manufacturing performance.

Weaknesses may include:

- Higher cost, making it less accessible for smaller manufacturers.

- The learning curve may be steep for users unfamiliar with advanced software.

Sage 100cloud enhances efficiency by streamlining processes across departments, ensuring better communication between accounting and production teams. Its MRP features allow manufacturers to minimize waste and maximize resource utilization.

- Fishbowl Manufacturing

Fishbowl Manufacturing focuses primarily on inventory management and manufacturing processes, making it an excellent choice for manufacturers seeking detailed production tracking.

Strengths include:

- Advanced inventory tracking features that provide real-time data on stock levels.

- Integration with QuickBooks, allowing for seamless financial management.

- Customization options to tailor the software to specific manufacturing needs.

However, it has its drawbacks:

- Limited accounting features necessitate integration with other software for full accounting capabilities.

- Initial setup can be time-consuming, requiring careful planning and execution.

Fishbowl Manufacturing can significantly improve operational efficiency by offering precise inventory management, which is crucial for just-in-time manufacturing processes. The integration with QuickBooks also facilitates streamlined financial management, enabling manufacturers to focus on production rather than administrative tasks.

Integration Capabilities of Accounting Software with Other Manufacturing Tools

In today’s fast-paced manufacturing environment, the ability to integrate accounting software with other essential manufacturing tools, such as ERP systems, is crucial for streamlined operations. Effective integration allows for real-time data sharing, which enhances decision-making processes and facilitates overall productivity across various departments.

Benefits of Integrating Accounting Software with Manufacturing Tools

Integrating accounting software with other manufacturing tools can significantly enhance operational efficiency. Such integrations provide a seamless flow of information, which minimizes the risk of errors caused by manual data entry and improves collaboration between teams. Below are some of the key benefits of these integrations:

- Real-Time Data Access: Integration ensures that financial data is updated in real time, allowing manufacturing managers to make informed decisions based on current information.

- Enhanced Accuracy: Automated data transfer between systems reduces the chances of human error, thereby increasing the reliability of financial reporting.

- Improved Workflow: By synchronizing processes, accounting software can help streamline operations such as inventory management, procurement, and order fulfillment, resulting in a more efficient workflow.

- Cost Savings: Integration reduces operational costs by decreasing the need for redundant data entry and minimizing discrepancies that may lead to costly mistakes.

Successful integrations can be seen in various manufacturing setups. For instance, a prominent automotive manufacturer integrated its accounting software with its ERP system, resulting in a 30% reduction in order processing time. This allowed the company to respond faster to market demands and improve customer satisfaction. Another example is a food processing company that connected its accounting software with inventory management tools, which led to better tracking of perishable goods.

This integration not only optimized stock levels but also reduced waste, enhancing overall profitability. Investing in accounting software that offers robust integration capabilities is essential for modern manufacturing businesses. These integrations streamline operations, enhance collaboration, and significantly decrease the likelihood of errors, ultimately contributing to a more efficient production environment.

Challenges Manufacturing Businesses Face When Implementing Accounting Software

Implementing accounting software in manufacturing businesses can be a complex undertaking. Various challenges can arise due to the unique nature of manufacturing operations, which often include intricate supply chains, diverse product lines, and distinct regulatory requirements. Understanding these challenges is critical to achieving a smooth implementation process.One of the primary obstacles is the lack of clear requirements. Manufacturing companies often struggle to articulate their specific accounting needs, leading to mismatches between the software capabilities and the business’s requirements.

Additionally, resistance to change from employees who are accustomed to traditional accounting methods can hinder successful adoption. Staff may feel overwhelmed by new technology, which could result in decreased morale and productivity during the transition period.

Common Obstacles in Software Implementation

Several common challenges can complicate the implementation process of accounting software in manufacturing businesses. Recognizing these obstacles can help in devising strategies to mitigate their effects:

- Inadequate Training: Employees may lack the necessary skills to effectively use the new software.

- Integration Issues: The software may not seamlessly integrate with existing systems, leading to data silos.

- Cost Overruns: Unexpected expenses can arise during implementation, affecting the overall budget.

- Data Migration Problems: Transferring historical data to the new system can be fraught with errors and complications.

- Compliance and Regulatory Challenges: Ensuring that the new system meets industry-specific regulations can be difficult.

The importance of proper planning cannot be overstated in minimizing implementation issues. Effective planning involves setting clear objectives and timelines, establishing a dedicated project team, and conducting thorough research on the selected software to ensure it aligns with business needs. It’s crucial to engage all stakeholders early in the process to gather insights and build a sense of ownership among the team.A phased approach to implementation can help alleviate stress.

Instead of a complete rollout, businesses can start with a pilot program in one area before expanding to the entire organization. This allows for adjustments based on feedback and minimizes disruptions. Furthermore, developing a comprehensive training program tailored to the varying skill levels of employees can significantly improve user adoption rates. Ultimately, a well-structured implementation strategy—backed by strong executive support and continuous communication—can pave the way for smoother transitions, ensuring that the accounting software becomes a valuable asset rather than a source of frustration.

Obtain direct knowledge about the efficiency of best ap automation software for small business through case studies.

The Role of Real-time Data in Manufacturing Accounting Software

In today’s fast-paced manufacturing environment, the ability to access real-time data is not just an advantage; it is crucial for maintaining competitiveness and operational efficiency. Real-time data tracking in manufacturing accounting software allows businesses to monitor their financial metrics continuously, enabling them to respond swiftly to changes in production, costs, and overall market conditions. The significance of this capability cannot be overstated, as it directly impacts decision-making and strategic planning.Real-time data enhances the accounting process in manufacturing by providing timely insights into various financial and operational metrics.

For example, tracking inventory levels in real time allows businesses to manage stock more effectively, reducing the risk of overproduction or stockouts. Additionally, real-time analytics on labor costs and production efficiency can guide managers in reallocating resources to maximize productivity and minimize waste.

Benefits of Real-time Analytics in Manufacturing Accounting Software

The adoption of accounting software equipped with real-time analytics can transform the way manufacturing businesses operate. Here are some notable benefits that underscore the importance of real-time data:

- Improved Financial Visibility: Real-time data offers a clear view of financial performance, allowing manufacturers to track revenues, costs, and profit margins as they occur. This transparency helps in accurate forecasting and budgeting.

- Enhanced Inventory Management: With real-time tracking of inventory levels, manufacturers can optimize their supply chain processes, ensuring they have the right materials at the right time, thereby avoiding excess inventory costs.

- Faster Decision-making: Access to real-time insights enables managers to make informed decisions quickly, such as adjusting production schedules or responding to changes in customer demand. This agility can result in a competitive edge in the marketplace.

- Cost Reduction: Analyzing real-time data can highlight inefficiencies within operations, such as excessive overtime or underutilized machinery. Addressing these issues can lead to significant cost savings.

- Increased Responsiveness to Market Changes: Monitoring real-time data allows manufacturers to quickly adapt to market trends, customer preferences, and even regulatory changes, thus enhancing their ability to meet demands effectively.

- Better Cash Flow Management: Real-time insights into accounts receivable and payable help businesses manage their cash flow more efficiently, ensuring they have sufficient liquidity to fund operations and growth initiatives.

Real-time data not only streamlines the accounting process but also fosters a culture of continuous improvement within manufacturing organizations. By leveraging analytics, manufacturers can identify trends, evaluate performance, and implement proactive strategies that drive efficiency and profitability. Therefore, adopting accounting software with robust real-time analytics capabilities is essential for manufacturing businesses aiming to thrive in an increasingly dynamic environment.

Customization Options Available in Accounting Software for Manufacturing

Customization in accounting software is essential for manufacturing businesses, as their operational needs differ significantly from other industries. Each manufacturing setup has unique processes, varying product types, and specific regulatory requirements. Customization allows businesses to tailor financial management tools that align closely with their operational workflows, ultimately enhancing efficiency and accuracy in financial reporting. With the right customization options, manufacturers can streamline their accounting processes, ensuring that they capture and analyze financial data relevant to their unique business model.Manufacturers often face challenges in financial management due to the complexity of their operations, which includes inventory management, production costs, and supply chain logistics.

Customization features in accounting software can help address these challenges effectively. These features might include:

Key Customization Features Beneficial for Manufacturers

Understanding the available customization features can empower manufacturers to select accounting software that truly meets their needs. Here are some of the key options to consider:

- Customizable Dashboards: These allow users to display key performance indicators (KPIs) relevant to their manufacturing operations, such as production costs, labor efficiency, and inventory levels, enabling quick decision-making.

- Tailored Reporting: Manufacturers can create reports that meet specific requirements, whether it’s tracking costs per product line or analyzing profit margins on specific items. This feature supports informed strategic planning.

- Integration with Existing Systems: Custom solutions can seamlessly integrate with existing manufacturing tools and Enterprise Resource Planning (ERP) systems, improving data flow and reducing the need for manual data entry.

- Workflows and Approval Processes: Customizable workflows can be developed to align with the manufacturing processes, ensuring that financial transactions are processed efficiently and approvals are obtained timely.

- Inventory Management Features: Custom inventory tracking can be developed to align with production schedules, enabling manufacturers to manage stock levels more effectively and reduce wastage.

Tailored accounting solutions contribute significantly to improving financial management within manufacturing firms. By customizing their accounting software, manufacturers can ensure that their specific processes are reflected accurately in financial data. This leads to timely insights into cash flow, cost management, and profitability, which are critical for maintaining a competitive edge. For example, a manufacturer that customizes its inventory management features can greatly reduce excess stock or stockouts, ultimately saving costs and enhancing customer satisfaction.

In summary, the importance of customization in accounting software cannot be overstated; it equips manufacturing businesses with the tools they need to navigate their complex financial landscapes effectively, paving the way for sustainable growth and efficiency.

Cost Considerations for Manufacturing Businesses Choosing Accounting Software

Selecting the right accounting software is a critical decision for manufacturing businesses, as it significantly impacts both financial performance and operational efficiency. Understanding the cost considerations involved in this selection process is essential to ensure that the investment aligns with the company’s budget and long-term goals.Various cost factors come into play when choosing accounting software for manufacturing businesses. First, the initial purchase price can vary widely based on the software’s features, complexity, and vendor reputation.

It’s essential to consider both one-time licensing fees and any recurring subscription costs, as these can accumulate over time. Additionally, factor in costs associated with implementation, including data migration, integration with existing systems, and employee training.

Budgeting for Software Acquisition and Maintenance, Accounting software for manufacturing business

Establishing a budget for accounting software requires a comprehensive understanding of both direct and indirect costs associated with the software lifecycle. Here are key elements to consider when setting your budget:

- Initial Costs: This includes the purchase price of the software, any setup fees, and the costs associated with training employees. Ensure to include all potential expenses to avoid unexpected costs later.

- Ongoing Subscription or Licensing Fees: Many accounting software solutions operate on a subscription model, meaning you’ll have monthly or annual fees that can add up over time. It’s crucial to review the terms of any contracts carefully.

- Implementation Costs: These may cover data migration, system integration, and any necessary customization. Depending on the complexity of your manufacturing processes, these costs can be substantial.

- Maintenance and Support: Regular updates and technical support are essential for keeping the software functional and secure. Budgeting for these ongoing expenses ensures that your software remains up-to-date with industry standards.

- Potential ROI: To evaluate the return on investment, consider how the software can streamline operations, reduce manual errors, and enhance reporting capabilities. For example, a manufacturing company that implemented robust accounting software could see a 20% reduction in financial discrepancies, leading to significant cost savings over time.

Understanding these cost factors assists manufacturing businesses in making informed decisions about which software solution to choose. By carefully assessing the financial implications, companies can ensure that their investment in accounting software yields positive returns and supports sustainable growth in the long run.

Training and Support Needs for Manufacturing Employees Using Accounting Software

Effective training and ongoing support are crucial for manufacturing employees who are tasked with using accounting software. As manufacturing processes become increasingly complex, the need for proficient handling of accounting systems grows as well. This not only ensures accuracy in financial reporting but also promotes a seamless integration of accounting practices within the operational workflow of the manufacturing business. By equipping employees with the necessary skills and knowledge, companies can enhance productivity, minimize errors, and ultimately improve their bottom line.Training requirements for employees using accounting software in a manufacturing environment encompass several key areas.

First, employees must be familiarized with the fundamental functionalities of the software, including data entry, reporting, and analysis tools. Additionally, understanding how to navigate the accounting software’s interface is essential for efficiency. Since manufacturing businesses often use the software to manage various financial aspects such as inventory, payroll, and cost accounting, training should also focus on these specific modules.

Importance of Ongoing Support and Resources

Ongoing support is essential for maintaining employee proficiency and confidence in using accounting software. The dynamic nature of manufacturing means that employees may encounter new challenges and updates that require additional assistance. Here are some important aspects of ongoing support:

- Help Desks and Technical Support: Establishing a reliable help desk ensures that employees have access to immediate assistance for troubleshooting and questions that arise during daily operations.

- Resource Availability: Providing a repository of training materials such as videos, manuals, and FAQs allows employees to self-educate and reference helpful resources as needed.

- Regular Update Training: As software updates are implemented, ongoing training sessions can help employees stay current with new features and best practices.

- Peer Support Programs: Encouraging collaboration among employees through mentorship or buddy systems can foster a supportive learning environment where staff share tips and problem-solving strategies.

Proper training significantly impacts software adoption and operational efficiency. When employees are well-trained, they can utilize the accounting software to its full potential, leading to reduced errors in financial reporting and enhanced data-driven decision-making. For example, a manufacturing company that invested in comprehensive training programs reported a 20% decrease in accounting errors within the first six months of implementation. This not only saved time and resources but also allowed the company to make informed decisions based on accurate financial data.

In summary, investing in thorough training and ongoing support for employees using accounting software can yield significant benefits, including streamlined operations, improved accuracy, and increased employee satisfaction.

Future Trends in Accounting Software for the Manufacturing Sector

The manufacturing sector is witnessing a significant transformation driven by advancements in technology and the evolving needs of businesses. As organizations strive for greater efficiency, accuracy, and real-time insights, the future of accounting software is positioned to adapt to these changes. Understanding these trends is crucial for manufacturers aiming to maintain a competitive edge and optimize their financial operations.One of the most prominent trends shaping accounting software for manufacturing is the increased adoption of artificial intelligence (AI) and machine learning (ML).

These technologies enable automated data analysis, allowing software to identify patterns, predict cash flow, and recognize anomalies in financial transactions. By leveraging AI and ML, manufacturers can enhance decision-making processes, reduce human error, and ultimately streamline operations.

Cloud Computing and Accessibility

The shift towards cloud computing continues to revolutionize the way accounting software is utilized within the manufacturing sector. Cloud-based solutions offer manufacturers the flexibility to access financial data anytime, anywhere, which is essential in today’s fast-paced environment. This trend not only promotes collaboration among teams but also enhances data security through regular updates and backups. The significance of cloud-based accounting software can be illustrated through the following benefits:

- Scalability: Manufacturers can easily adjust their software capabilities based on growth without significant upfront costs.

- Real-Time Collaboration: Teams across different locations can work on financial reports simultaneously, facilitating quicker decision-making.

- Cost Efficiency: Reduced need for on-premise infrastructure translates to lower maintenance and operational costs.

Another emerging trend is the integration of accounting software with Internet of Things (IoT) technology. With IoT devices providing real-time data from manufacturing processes, accounting software can utilize this information to improve inventory management, cost tracking, and financial forecasting. For instance, sensors on production equipment can relay data on operational efficiency, which can be translated into financial metrics, enabling more accurate budgeting and resource allocation.

Enhanced Data Analytics and Reporting

The demand for more sophisticated data analytics tools is reshaping the expectations for accounting software. Manufacturers are increasingly looking for solutions that provide customizable dashboards and advanced reporting capabilities. The ability to visualize financial data through graphs and charts enhances understanding and helps in strategic planning.The rise of advanced data analytics is reflected in:

- Predictive Analytics: Tools that analyze past data to forecast future trends, aiding manufacturers in strategic planning.

- Custom Reporting: Tailored reports that provide insights specific to various manufacturing processes, allowing for better financial oversight.

- Integration with Business Intelligence (BI) Tools: Seamless connections with BI platforms enable deeper insights and facilitate data-driven decision-making.

Furthermore, the growing focus on sustainability and eco-friendly practices within manufacturing is likely to influence accounting software development. As companies strive to meet regulatory requirements and improve their environmental impact, accounting solutions are expected to incorporate features that track sustainability metrics alongside traditional financial data.In summary, the future of accounting software in the manufacturing sector is set to be shaped by AI, cloud computing, IoT integration, advanced analytics, and sustainability tracking.

Manufacturers who stay ahead of these trends will not only enhance their operational success but also ensure they are equipped to meet the challenges of an ever-evolving industry landscape.

Last Word

In summary, the right accounting software can play a pivotal role in enhancing the efficiency of manufacturing businesses. By addressing the specific needs of the industry, embracing integration with other tools, and keeping an eye on emerging trends, manufacturers can optimize their financial management processes. Investing in robust accounting solutions not only improves operational efficiency but also positions businesses for success in a competitive environment.

Key Questions Answered: Accounting Software For Manufacturing Business

What features should I look for in accounting software for manufacturing?

Look for features that support inventory management, cost tracking, production scheduling, and integration with ERP systems.

How can accounting software improve efficiency in manufacturing?

By automating financial processes, providing real-time data, and enabling better resource allocation, accounting software can significantly enhance operational efficiency.

Is real-time data tracking necessary for manufacturing accounting?

Yes, real-time data tracking is essential as it enables timely decision-making and enhances overall operational efficiency.

What challenges might arise when implementing accounting software?

Common challenges include resistance to change, inadequate training, and integration issues with existing systems.

How can I ensure effective training for employees using accounting software?

Provide comprehensive training sessions, ongoing support resources, and encourage feedback to improve the learning process.