Accounting software for mac desktop is increasingly becoming a vital tool for businesses seeking efficiency and accuracy in managing their finances. With the evolution of technology, these applications have transformed significantly, catering specifically to Mac users. From early software options that laid the groundwork to modern solutions boasting advanced features, understanding this evolution provides valuable insight into the current landscape of accounting software tailored for mac desktops.

This overview will take you through essential features to look for, popular options on the market, and the role of cloud integration. Additionally, it will cover the customization and scalability of software solutions, integration with other business tools, and the importance of user support. By exploring these elements, you’ll be equipped with the knowledge needed to choose the right accounting software that fits your business needs.

The Evolution of Accounting Software for Mac Desktop

The landscape of accounting software has undergone a significant transformation since its inception, particularly for Mac users. As technology has advanced, so too have the functionalities and features available in accounting applications. This evolution reflects a broader trend in computing, where user needs and technological capabilities converge to create more efficient and user-friendly tools.The journey of accounting software for Mac began in the late 1980s, shortly after the launch of the first Macintosh computers.

Early adopters recognized the potential of integrating financial management tasks with the emerging desktop computing technology. The original accounting software options were limited, often featuring basic bookkeeping functionalities that catered to small businesses.

Historical Development of Accounting Software for Mac Users

The evolution of accounting software can be traced through several key phases that underscore the relationship between technological progress and user expectations. Initially, the software was designed for simple tasks such as ledger management and invoicing. As Mac computers became more powerful and user-friendly, so did the software. Significant advancements in software development introduced graphical user interfaces (GUIs), making these applications more accessible to users unfamiliar with complex coding.Some notable early software options included:

- MacInTax (mid-1990s): This program was among the first to provide tax filing assistance for Mac users, significantly simplifying the tax preparation process.

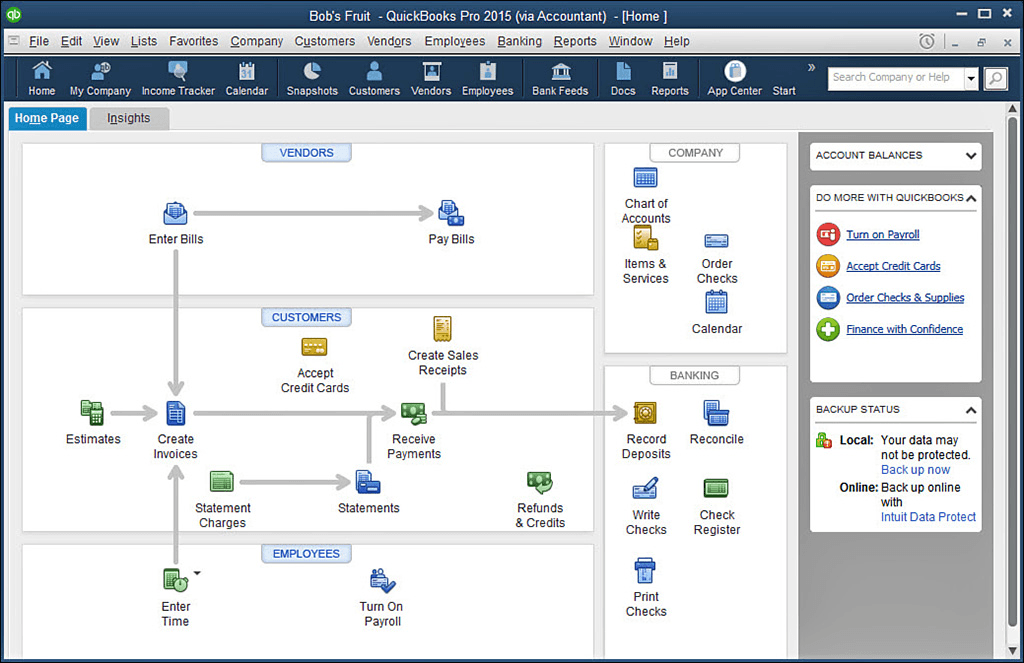

- QuickBooks for Mac (1999): A major milestone, this software enabled small businesses to manage their finances with ease, bringing advanced features like inventory management and payroll processing to the Mac platform.

- MoneyWorks (1993): Known for its robust accounting capabilities, MoneyWorks offered users an effective solution for invoicing and reporting, establishing a strong user base that valued its reliable features.

The impact of these early applications on users was profound, as they not only streamlined accounting tasks but also enhanced the accuracy and efficiency of financial reporting. Users began to recognize the benefits of digital record-keeping, which ultimately laid the groundwork for more sophisticated software offerings in the years to come.Technological advancements in hardware and software architecture have continued to influence the capabilities of accounting applications.

The introduction of cloud computing and mobile access has revolutionized how businesses manage their finances. Modern accounting software for Mac now supports real-time collaboration, making it easier for teams to work together seamlessly, regardless of location.The integration of artificial intelligence and automated functionalities has further transformed the landscape, allowing for predictive analytics and enhanced reporting capabilities that were once unimaginable.

Users can now rely on advanced algorithms to provide insights into cash flow and financial health, making informed decisions based on data-driven forecasts.Overall, the evolution of accounting software for Mac has been characterized by a commitment to enhancing usability and functionality, ensuring that businesses can efficiently meet their accounting needs in an increasingly digital world.

Key Features to Look for in Mac Desktop Accounting Software

Selecting the right accounting software for your Mac desktop involves understanding the unique features that set it apart from other platforms. Mac users often seek software that is not only functional but also visually appealing and user-friendly. This ensures a seamless experience that integrates well with Mac’s operating system, enhancing productivity and efficiency.When evaluating accounting software for Mac desktops, essential functionalities such as invoicing, expense tracking, and financial reporting become crucial.

These features contribute significantly to the overall effectiveness of the software in managing finances and streamlining business operations. An intuitive interface and a positive user experience can greatly influence the suitability of the software for various business needs.

Invoicing Features

Invoicing is a core function of accounting software, allowing businesses to send out professional invoices quickly and easily. Look for features that enhance this process:

- Customizable Templates: The ability to create personalized invoices with your branding fosters a professional appearance.

- Recurring Invoices: Automating recurring billing can save time and ensure consistent cash flow management.

- Payment Tracking: Features that allow tracking of invoice payments help in managing accounts receivable effectively.

- Multi-Currency Support: Businesses dealing with international clients benefit immensely from the ability to invoice in different currencies.

Expense Tracking Capabilities

Effective expense tracking is vital for maintaining a healthy financial status. Software that simplifies this process can make a significant difference:

- Receipt Scanning: Utilizing optical character recognition (OCR) technology allows users to scan and store receipts directly into the software.

- Expense Categorization: Automatic categorization of expenses based on predefined tags can save time and enhance reporting accuracy.

- Integration with Bank Accounts: Connecting the software to bank accounts enables automatic import of transaction data, facilitating real-time expense tracking.

- Mileage Tracking: For businesses requiring travel, integrated mileage tracking can ensure that all expenses are accounted for accurately.

Financial Reporting Tools

The ability to generate detailed financial reports is another crucial aspect of robust accounting software. Here are some key reporting tools to consider:

- Customizable Reports: Users should be able to create tailored reports to meet specific business needs, allowing for better insights.

- Real-Time Dashboards: Visual dashboards provide at-a-glance views of financial health, helping users to make informed decisions quickly.

- Tax Reporting Features: Automated tax calculations and reporting help in compliance and reduce the burden during tax season.

- Forecasting Tools: Predictive analytics features can assist in budgeting and financial planning by projecting future income and expenses.

User Experience and Interface Design

A well-designed user interface significantly enhances the usability of accounting software. Mac users often prioritize software that adheres to the aesthetic and functional standards of macOS. Key elements to evaluate include:

- Sleek Design: The software should feature a visually appealing layout that aligns with Mac’s design philosophy, making navigation intuitive.

- Ease of Navigation: Clear menus and accessible features improve workflow efficiency and reduce the learning curve for new users.

- Responsive Customer Support: Access to user support and instructional resources can enhance the user experience, making problem-solving easier.

- User Community: A supportive user community can provide additional resources, tips, and tricks for utilizing the software effectively.

Comparing Popular Accounting Software for Mac Desktops

When it comes to selecting accounting software for Mac desktops, understanding the available options can significantly affect your business operations. Each software solution has its own unique features, strengths, and weaknesses. In this section, we will delve into a comparison of some of the most popular accounting software options on the market, highlighting their pros and cons to help inform your decision.Choosing the right accounting software involves more than just picking the most popular option.

You should consider factors like pricing, customer support quality, and compatibility with other tools you already use. Below is a comprehensive comparison of notable accounting software available for Mac desktops.

Comparison Table of Accounting Software for Mac Desktops

The following table summarizes key features, advantages, and disadvantages of popular accounting software options:

| Software | Pros | Cons |

|---|---|---|

| QuickBooks for Mac |

|

|

| Xero |

|

|

| FreshBooks |

|

|

| Zoho Books |

|

|

Factors to Consider When Choosing Accounting Software

Selecting the right accounting software can be a challenging task, and there are several factors to keep in mind when making your decision. Pricing is one of the most critical considerations; it’s essential to find a software solution that fits your budget without compromising on necessary features. Additionally, the level of customer support provided can impact how smoothly you can resolve issues and get assistance when needed.

Lastly, integrations with other applications you use, such as payment processors or CRM tools, can streamline your business operations and increase overall efficiency.

User Experiences and Testimonials

Real-life experiences can give valuable insights into how each accounting software performs in daily operations. Here are some testimonials:

“QuickBooks has been a lifesaver for my small business. The reporting features are intuitive, and I can always count on their support team for help when I need it.” – Sarah K., Small Business Owner

“I love Xero for its cloud-based functionality. I can manage my finances from anywhere, but I did have to invest time to learn how to use it effectively.” – John M., Freelancer

“FreshBooks is perfect for my freelance work. The interface is easy to navigate, and the customer support is outstanding.” – Lisa T., Freelancer

For descriptions on additional topics like advanced inventory in quickbooks enterprise, please visit the available advanced inventory in quickbooks enterprise.

“Zoho Books offers all the features I need at an affordable price, but I wish their support was a bit more responsive.” – Mark R., Entrepreneur

The Role of Cloud Integration in Mac Accounting Solutions

Cloud technology has revolutionized the landscape of accounting software for Mac desktops, enhancing traditional capabilities and providing users with a more flexible and efficient way to manage their finances. By integrating cloud solutions, accounting software can leverage remote access, real-time updates, and collaborative features that significantly improve the overall user experience and operational efficiency.The implementation of cloud technology enables Mac accounting software to offer several advantages that are essential for modern businesses.

One key benefit is the ability to access financial data in real-time from anywhere, allowing users to stay updated and make informed decisions without being tethered to their desks. This level of accessibility fosters collaboration among team members, enabling multiple users to work on financial reports simultaneously, regardless of their physical location.

Benefits of Real-Time Data Access and Collaboration

Real-time data access is a game-changer for accounting professionals, as it enhances productivity and accuracy. With cloud-integrated accounting solutions, users can instantly view and update financial records, which is particularly beneficial during critical periods such as month-end closing or tax season. The collaborative nature of cloud accounting allows for seamless sharing of information, reducing the risk of errors due to miscommunication or outdated data.

Immediate Updates

Users receive instant notifications whenever changes are made, ensuring everyone is on the same page.

Multi-User Access

Teams can simultaneously access the software, facilitating faster decision-making and reducing bottlenecks.

Enhanced Communication

Built-in messaging or commenting features allow users to discuss changes or strategies directly within the software, streamlining workflows.

Security Measures in Cloud Accounting Software, Accounting software for mac desktop

Given the sensitive nature of financial data, security is a paramount concern for businesses when adopting cloud accounting solutions. To address these concerns, reputable cloud accounting software implements several robust security measures to safeguard information against unauthorized access and breaches.These measures typically include:

Data Encryption

Financial information is encrypted both in transit and at rest, making it unreadable to anyone without proper authorization.

Multi-Factor Authentication (MFA)

Users must provide multiple forms of identification to access their accounts, adding an extra layer of security.

Regular Security Audits

Service providers frequently conduct audits to ensure their security protocols are up to date and effectively protecting user data.

By integrating cloud technology, Mac accounting solutions not only enhance user flexibility but also prioritize the security of sensitive financial information.

Adopting cloud-integrated accounting software is no longer a luxury but a necessity for businesses looking to stay competitive in the evolving financial landscape. The combination of real-time data access, collaborative features, and stringent security measures makes these solutions an attractive option for Mac desktop users seeking efficiency and peace of mind in their accounting practices.

Customization and Scalability of Accounting Software for Growing Businesses

As businesses grow and evolve, their accounting needs become increasingly complex. Customization and scalability in accounting software are essential components that allow businesses to adapt to their unique requirements while ensuring they can scale operations without interruption. Investing in software that caters specifically to the individual needs of a business can streamline processes, improve efficiency, and facilitate better financial decision-making.Customization in accounting software enables businesses to tailor features according to their specific operational needs.

This flexibility can include the ability to configure reports, workflows, and even user permissions. For instance, a manufacturing company may require distinct inventory tracking capabilities compared to a service-based business that needs robust billing and invoicing features. The right software not only accommodates these differences but can also grow with the business.

Importance of Customization in Accounting Software

Customization plays a critical role in maximizing the effectiveness of accounting software. Here are some key aspects highlighting its importance:

- Industry-Specific Features: Certain software options allow businesses to incorporate industry-specific tools. For example, construction businesses can utilize software with job costing and project management functionalities, while retail businesses may focus on inventory tracking and sales analytics.

- User Interface Adjustment: Tailoring the user interface can enhance the user experience. Different team members, such as accountants, managers, or sales staff, can benefit from customized dashboards that show relevant metrics and KPIs.

- Integration with Existing Systems: Customizable accounting software can easily integrate with other business systems, such as CRM platforms or payroll solutions, enabling seamless data flow and reducing manual data entry.

Scalability in Accounting Solutions

Scalability is crucial for businesses that are planning to expand, as it ensures that their accounting software can accommodate increased transaction volumes and additional users without compromising performance. Scalable solutions not only support growth but also reduce the need for frequent software changes, which can be disruptive.

- Modular Functionality: Some accounting software offers a modular approach, allowing businesses to add new features as they grow. For example, a startup might begin with basic bookkeeping functions and later add advanced reporting, payroll, and inventory management as their needs evolve.

- Cloud-Based Solutions: Many modern accounting solutions utilize cloud technology, which inherently supports scalability. Businesses can adjust their subscription plans based on their current needs, ensuring they only pay for what they use.

- Multi-Currency and Multi-Entity Support: For businesses that plan to operate internationally, scalable accounting software should facilitate multi-currency transactions and support multiple entities, making it easier to manage global operations.

Examples of Scalable Accounting Software

Several accounting software options exemplify customization and scalability tailored to different industries:

- Xero: Known for its easy integration with over 800 apps, Xero allows businesses to customize features according to their specific needs, from invoicing to project management.

- QuickBooks Online: This solution offers various plans that can be tailored to different business sizes and growth stages, with options for advanced reporting and multi-user access.

- FreshBooks: Ideal for service-based businesses, FreshBooks provides customizable invoicing options and time-tracking features, which can adapt as the business grows.

“Customizable and scalable accounting software allows businesses to not just keep up with growth, but to thrive and innovate in their financial management.”

Integrating Mac Accounting Software with Other Business Tools

Integrating accounting software with other business tools is essential for streamlining financial processes, enhancing productivity, and ensuring data accuracy across various departments. An efficient integration allows businesses to synchronize data between different applications, reducing the chances of errors and saving time in manual data entry. By linking accounting software with tools like customer relationship management (CRM) systems and inventory management platforms, organizations can create a cohesive ecosystem that supports better decision-making and operational efficiency.Integrating accounting software with other business applications not only improves workflow but also provides a unified view of critical business metrics.

This integration can include connections with sales platforms, project management applications, and e-commerce systems, allowing businesses to manage their operations more effectively. Here are some popular business tools that can be effectively integrated with Mac accounting software:

Popular Business Tools for Integration

A variety of applications can enhance the functionality of Mac accounting software when integrated. Below are key tools that businesses often choose to integrate:

- CRM Systems: Tools like Salesforce or HubSpot help manage customer interactions and data, enabling businesses to track sales and maintain customer relationships seamlessly.

- Inventory Management Systems: Solutions such as TradeGecko or Cin7 help businesses track stock levels, manage orders, and automate inventory processes, which can be synced with accounting software for real-time financial updates.

- E-commerce Platforms: Integrating platforms like Shopify or WooCommerce allows businesses to automatically sync sales data, improving accuracy in financial reporting and inventory management.

- Project Management Tools: Applications like Asana or Trello can be integrated to track project expenses and budgets directly within the accounting system, ensuring better financial oversight.

- Payment Processing Solutions: Integrations with platforms like PayPal or Stripe streamline payment collection and revenue recognition, reducing discrepancies in financial records.

Setting up these integrations typically involves configuring API connections or using built-in integration features provided by the accounting software. Users may need to follow these steps:

- Identify the tools you want to integrate and ensure they are compatible with your Mac accounting software.

- Access the integration settings within your accounting software dashboard and select the desired application.

- Authorize the connection by providing necessary credentials and permissions, ensuring both systems can exchange data securely.

- Map data fields where necessary, aligning the information shared between the applications to maintain consistency.

- Test the integration, monitoring for any discrepancies or issues before fully relying on it for daily operations.

The benefits of these integrations are manifold. They enhance data accuracy by eliminating manual entry, improve reporting capabilities through centralized data collection, and facilitate real-time visibility into financial health across various business functions. By leveraging these tools, businesses can make informed decisions based on comprehensive insights drawn from multiple data sources.

Integrating accounting software with other applications creates a seamless workflow that enhances operational efficiency and data accuracy.

User Support and Resources for Mac Accounting Software: Accounting Software For Mac Desktop

Effective customer support and readily available resources are crucial for users navigating Mac accounting software. As these tools often handle sensitive financial data and complex calculations, having access to reliable help enhances user confidence and efficiency. The level of support can significantly influence the overall user experience, ensuring that businesses can leverage their software to its fullest potential without unnecessary delays or frustrations.Various channels exist for users to seek assistance with their Mac accounting software.

These can include online forums, comprehensive tutorials, and direct support options like live chat or phone consultations. Each channel serves a unique purpose, allowing users to engage with resources that suit their individual needs.

Channels for User Support

The following support channels provide essential resources for users of Mac accounting software, helping them resolve issues and maximize software capabilities:

- Online Forums: Forums are invaluable for users to connect with each other and share their experiences. Many software providers host user communities where questions can be asked, and solutions can be discussed. These platforms often feature threads dedicated to common issues, allowing users to find answers quickly without needing direct support.

- Tutorials and Knowledge Bases: Most accounting software companies maintain comprehensive libraries of tutorials, FAQs, and knowledge base articles. These resources cover everything from basic setup to advanced features, enabling users to learn at their own pace and troubleshoot independently.

- Direct Support: For more complex issues, direct support channels such as live chat, email, or phone support are essential. Responsive customer service teams can provide tailored assistance, ensuring users can resolve specific problems efficiently.

- Webinars and Training Sessions: Many software vendors offer live webinars and training sessions to help users become acquainted with the software. These sessions often include demonstrations and Q&A segments, providing users with a thorough understanding of features and best practices.

“The right support can transform a user’s experience, turning challenges into opportunities for growth.”

Success stories highlight the positive impact of effective support on user experiences. For example, a small business utilizing a popular Mac accounting software reported a significant increase in productivity after participating in a training webinar. They learned how to automate invoicing, which saved hours every week and allowed them to focus more on core business activities.In another instance, a startup faced difficulties integrating their accounting software with project management tools.

After reaching out to customer support, they received targeted guidance that resolved their issues quickly. This not only improved their software experience but also enhanced overall operational efficiency by streamlining workflows.These examples underscore the importance of user support and resources in maximizing the effectiveness of Mac accounting software, showing that with the right assistance, users can achieve their business goals more effectively.

Common Challenges Faced by Mac Users When Using Accounting Software

Accounting software for Mac users offers a range of benefits, but it also presents unique challenges that can hinder productivity and efficiency. These challenges often stem from compatibility issues, differences in software design, and the need for robust user support. Understanding these obstacles is crucial for any Mac user looking to streamline their accounting processes.One prominent challenge faced by Mac users is software compatibility.

Many accounting programs are designed primarily for Windows systems, leading to issues when attempting to install or run them on macOS. This can result in reduced functionality or, in some cases, total incompatibility. Additionally, hardware compatibility may pose problems, as certain peripherals like printers or scanners might not have drivers available for macOS, complicating the accounting workflow.

Compatibility Issues with Other Software and Hardware

The compatibility of accounting software with other applications and hardware is critical for seamless operations. For Mac users, the following points highlight common compatibility challenges:

- Limited Software Availability: Some accounting solutions are not offered in macOS versions, forcing users to rely on less optimal alternatives or virtual machines that run Windows.

- Driver Issues: Printers, scanners, and other devices may lack macOS-compatible drivers, leading to difficulties in generating hard copies of important financial documents.

- Integration Challenges: Many popular business tools and CRM systems may not have native integrations with Mac accounting software, which can limit functionality and efficiency.

To address these challenges, users can implement several actionable strategies. First, researching software options that are explicitly designed for macOS can minimize compatibility issues. Many robust accounting solutions now provide native Mac versions, ensuring that users can access all features without the hassle of workarounds. Additionally, using virtualization software such as Parallels or VMware Fusion allows Mac users to run Windows applications within macOS, expanding their options for accounting tools without sacrificing performance.

Furthermore, checking for updated drivers and engaging with support forums or communities can provide solutions for hardware-related issues, enabling users to maximize their accounting software capabilities effectively.

“Understanding compatibility is key to overcoming common challenges faced by Mac users in accounting software.”

By staying informed about software updates and community resources, Mac users can navigate the challenges of using accounting software more effectively, ensuring that their financial management processes run smoothly.

Future Trends in Accounting Software for Mac Desktops

The landscape of accounting software for Mac desktops is continually evolving, driven by advancements in technology and changing user needs. As businesses adapt to new challenges and opportunities, the future of accounting software will likely focus on enhancing efficiency, user experience, and integration capabilities. This segment explores the emerging trends that are set to shape the future of accounting software specifically for Mac users.The integration of artificial intelligence (AI) and automation into accounting practices stands out as a pivotal trend.

AI-driven tools are enhancing data accuracy, reducing repetitive tasks, and enabling smarter decision-making by providing real-time insights. Automation can significantly streamline processes like invoicing, expense tracking, and financial reporting, allowing accountants to focus on strategic analysis rather than mundane data entry. As machine learning algorithms evolve, they will learn from user behaviors, further customizing the accounting experience.

Impact of Artificial Intelligence and Automation on Accounting Practices

The influence of AI and automation on accounting practices promises to revolutionize how financial professionals operate. With the capability to analyze vast amounts of data quickly, AI can identify trends and anomalies much faster than traditional methods. This results in more accurate forecasting and risk assessment. Here are some key aspects of this trend:

- Data Accuracy: AI systems can minimize human error by validating entries and flagging discrepancies in real-time.

- Time Efficiency: Routine tasks such as bank reconciliations and report generation can be automated, freeing up time for higher-level analysis.

- Enhanced Insights: Advanced analytics powered by AI can generate actionable insights, helping businesses make informed decisions quickly.

Moreover, the rise of chatbots and virtual assistants within accounting software is enhancing user interaction. These tools provide instant support, answer common queries, and facilitate navigation through complex software features, making the overall experience more user-friendly.

Evolving User Needs and Their Influence on Software Development

As businesses grow, their accounting needs also evolve. Future accounting software will likely be designed with scalability and customization at its core to accommodate the diverse requirements of users. Here are some factors shaping this evolution:

- Increased Demand for Integration: Users are looking for seamless integration with other business tools like CRM systems, e-commerce platforms, and payroll software to create a unified workflow.

- Focus on User Experience: With more businesses using remote work models, accounting software must prioritize intuitive interfaces and mobile accessibility, ensuring users can manage their finances on-the-go.

- Regulatory Compliance: As regulations change, software will need to adapt quickly to ensure compliance, particularly in areas like data protection and tax laws.

The necessity for ongoing training and support will also drive software development. As accounting practices become more complex, offering robust educational resources and user support will be essential in helping users maximize the potential of their accounting software.

“Accounting software for Mac desktops is not just about managing finances anymore; it’s about providing insights and enabling strategic growth.”

Last Point

In conclusion, selecting the right accounting software for mac desktop can significantly streamline your financial operations and enhance your business productivity. With a wide array of features, options for customization, and the ability to integrate with other tools, there’s a solution tailored for every type of business. By staying informed about current trends and leveraging user support, you can ensure that your accounting software continues to evolve alongside your business needs.

Q&A

What types of businesses benefit from accounting software for Mac desktops?

Small to medium-sized businesses, freelancers, and even larger organizations can benefit from accounting software designed for Mac desktops, as it enhances financial management and reporting.

Can I use accounting software on multiple devices?

Many modern accounting software options offer cloud integration, allowing you to access your data from multiple devices, including tablets and smartphones.

Is there a free accounting software option available for Mac?

Yes, there are several free accounting software options for Mac, although their features may be limited compared to paid versions.

How do I choose the right accounting software for my needs?

Consider factors such as your budget, required features, ease of use, customer support, and integration capabilities when selecting accounting software.

Are updates and support included with the software purchase?

This varies by provider; some offer ongoing updates and support as part of the purchase, while others may require separate subscriptions.